Form 1099 Deadline 2024

-

Create Account

-

Add Payer Details

-

Add Payee Details

-

Enter Payments

-

Pay & Transmit

See our 1099 Software Plans & Pricing

With pricing as low as $0.80/form, there is no better value to file 1099 online.

How ExpressIRSForms Stands Out From the Rest

Upload Files Instantly

You can upload data for multiple 1099 tax Forms within just a few minutes using our provided Excel template or an Excel template of your own.

1099 Form Corrections

You can easily avail Form 1099 corrections if you have previously filed your 1099 returns with ExpressIRSForms, thanks to our simple step-by-step correction and re-file process.

Instant Mail-Ready PDFs

Print and mail your employee forms instantly after you e-file with ExpressIRSForms. Or have us do it for you - we’ll mail your employee copies upon request!

Free Form W-9 E-signing

Before you file 1099 return, do you need your recipient’s information? Have them complete a Form W-9 through ExpressIRSForms quickly, securely, and free of cost!

Supported 1099 Forms

The 1099 Forms are information returns that need to be filed every year with the IRS to report payments other than wages that constitute as income throughout the year. ExpressIRSForms helps you e-file 1099 Forms that you need - NEC, MISC, INT, DIV, R, B, K, C, G, PATR and S - easily and in no time at all!

With ExpressIRSForms, you can easily e-file these 1099 Forms:

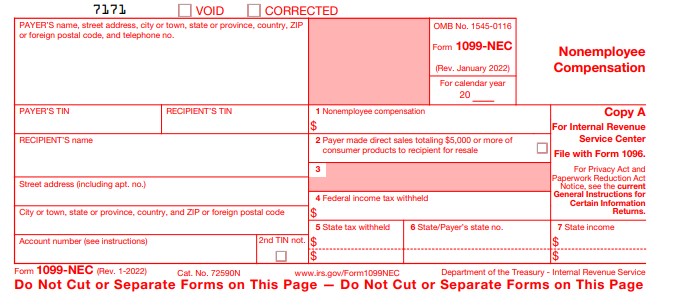

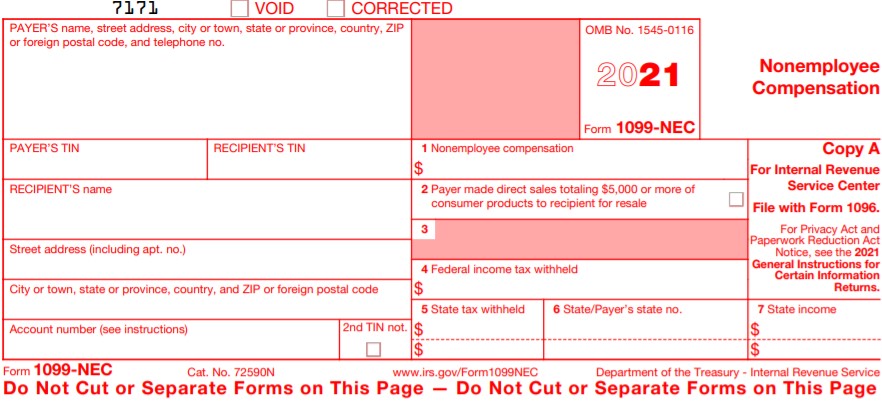

Information Needed to E-file Form 1099-NEC:

- Payer Details: Name, TIN, and Address

- Recipient Details: Name, TIN, and Address

- Nonemployee compensation

- Federal income tax withheld

- State Filing Details: State Income, Payer State Number, and State Tax Withheld

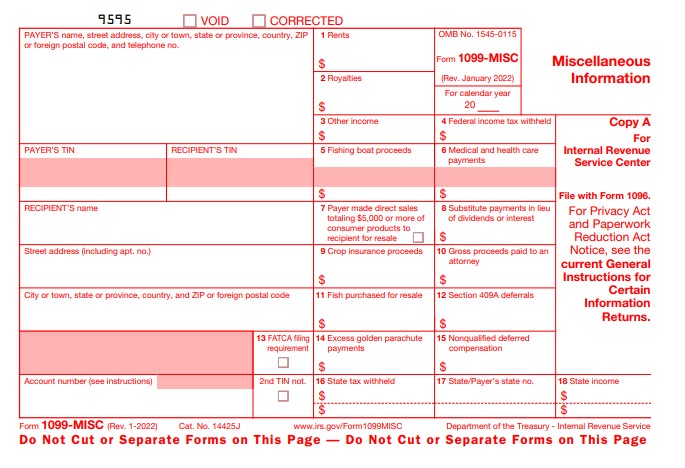

Information Needed to E-file Form 1099-MISC:

- Payer Details: Name, EIN, Address, Payer Type, and Employee Code

- Recipient Details: Name, SSN, Address, and Contact Information

- Federal Details: Federal Income and Federal Tax Withheld

- State Details: State Income, Payer State Number, and State Tax Withheld

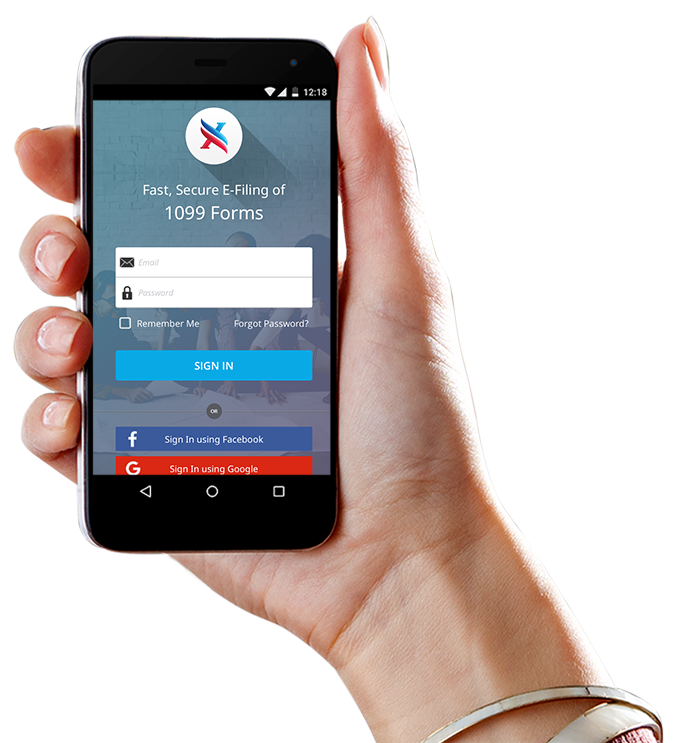

Now you can e-file 1099-MISC from your iPhone, iPad, and Android devices.

Download the FREE App Today

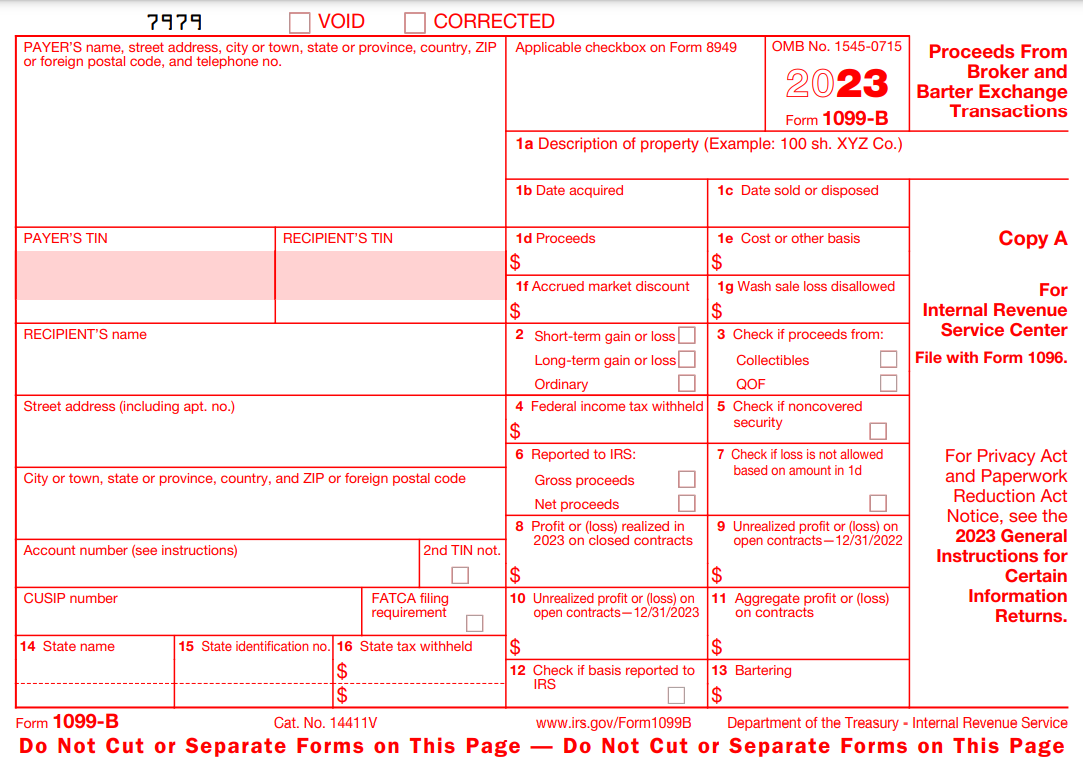

Information Needed to E-file Form 1099-B:

- Payer Details: Name, EIN, Address, Contact Number

- Recipient Details: Name, SSN, Address, and Contact Information

- Federal Details: Description of Property, Proceeds and Federal Tax Withheld

- State Details: State Identification Number and State Tax Withheld

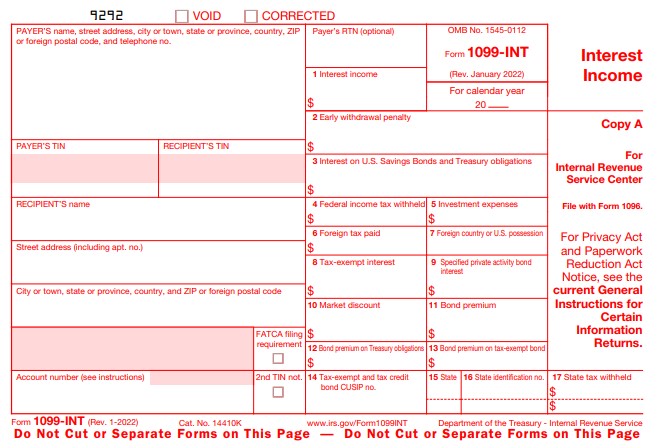

Information Needed to E-file Form 1099-INT:

- Payer Details: Name, EIN, Address, and Payer RTN (optional)

- Recipient Details: Name, SSN, Address, and Contact Information

- Federal Details: Federal Interest Income and Federal Tax Withheld

- State Details: State Name, ID Number, and State Tax Withheld

Now you can e-file 1099-INT from your iPhone, iPad, and Android devices.

Download the FREE App Today

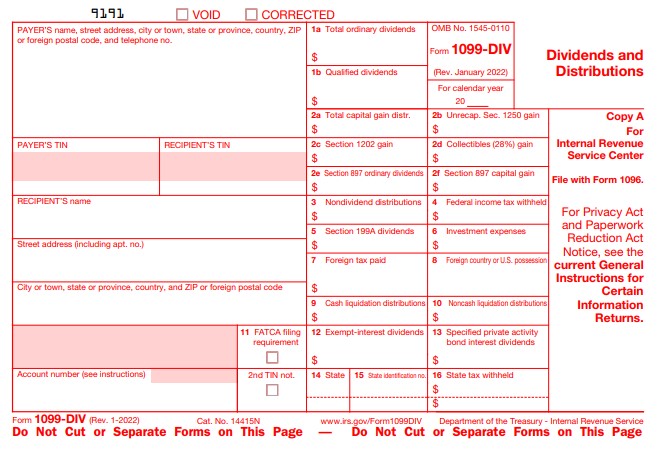

Information Needed to E-file Form 1099-DIV:

- Payer Details: Name, EIN, Address, and Contact Information

- Recipient Details: Name, SSN, Address, and Contact Information

- Federal Details: Dividends Received and Federal Tax Withheld

- State Details: State Name, ID Number, and State Tax Withheld

Now you can e-file 1099-DIV from your iPhone, iPad, and Android devices.

Download the FREE App Today

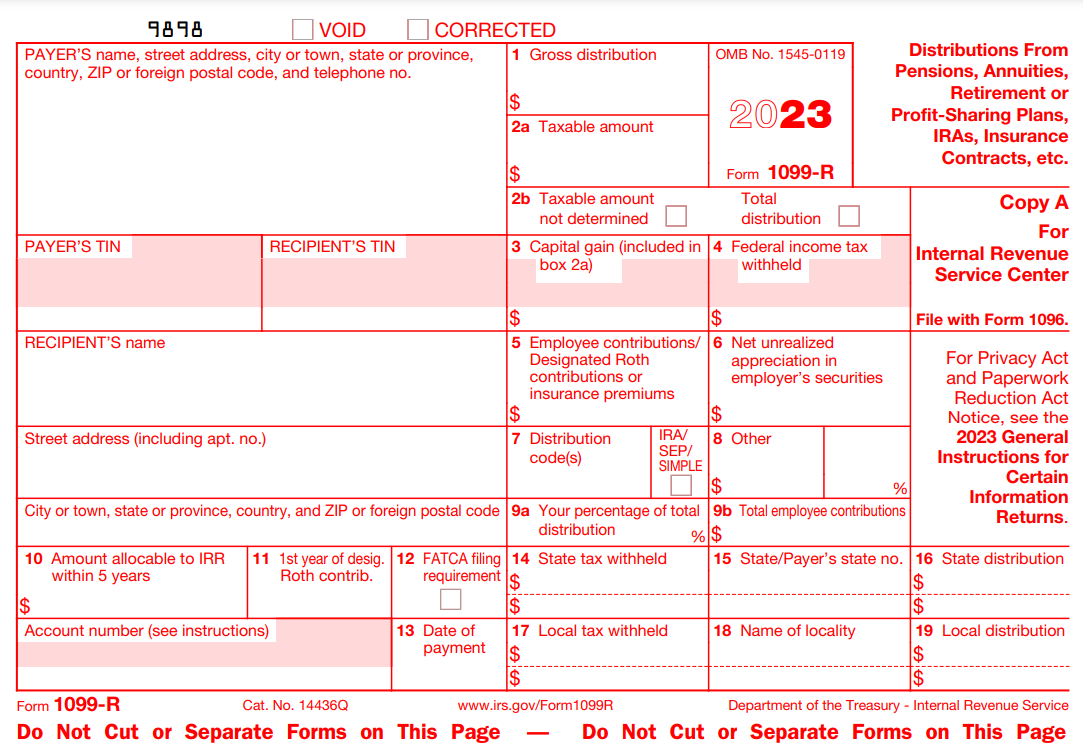

Information Needed to E-file Form 1099-R:

- Payer Details: Name, EIN, Address, and Account Number

- Recipient Details: Name, SSN, Address, and Contact Information

- Federal Details: Federal Income and Federal Tax Withheld

- State Details: State Number, Distribution, and Tax Withheld

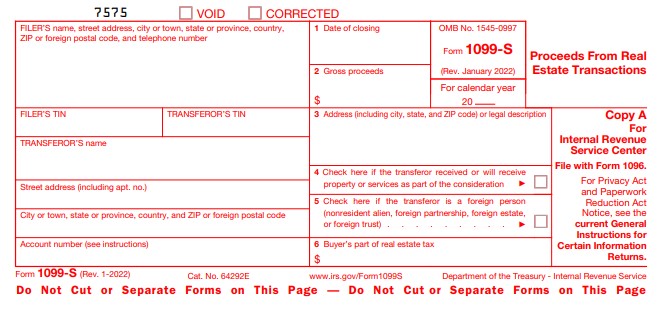

Information Needed to E-file Form 1099-S:

- Filer Details: Name, EIN and Address

- Transferor Details: Name, SSN, Address and Account Number

- Federal Details: Gross Proceeds, Buyer's Part of Real Estate Tax

1099 Form Correction:

File the correction form for mistakes made when filing your Form 1099 with the IRS. It’s easy now to file your 1099 correction Form with a secure IRS-Authorized agent like ExpressIRSForms.

1099 Correction Forms can be used to fix two types of errors:

- Type 1: Incorrect tax amount(s), or to void a return.

- Type 2: Missing/incorrect payee TIN, incorrect name or address, or the return was filed on the wrong form.

Frequently Asked Questions: Form 1099

No. Form 1096 is only required to be submitted when paper filing. Our e-filing system does, however, automatically generate Form 1096 for your records.

You can get an automatic 30-day extension for your 1099 Forms by using Form 8809. ExpressIRSForms can even help you e-file this extension form!

ExpressIRSForms handles this with ease: simply use one of our two upload options, Smart Upload or Bulk Upload.

-Smart Upload: Upload all your data at once using your own 1099 Excel template.

-Bulk Upload: Use our Excel sheet to input and upload your data all at once.

-Google sheets upload: Easily transfer your 1099 information by copying and pasting it directly into ExpressIRSForms. Learn More

-Copy & Paste: Conveniently upload Google Sheets directly from your drive, ensuring seamless data integration and efficient form processing. Learn More

Click here to know more about our bulk filing feature.

Yes. ExpressIRSForms supports state filing for 1099 Forms. Learn more on 1099 State Filings.

You can easily correct Type 1 and Type 2 errors on your 1099 Forms by using the 1099 Correction option in your ExpressIRSForms account.