How to File Tax Extension online?

-

Create Account

-

Add Your Business/ Personal details

-

Add your Balance Tax due Details

-

Review your Form

-

Transmit your Form

to the IRS

Information Required to File Tax Extension Forms

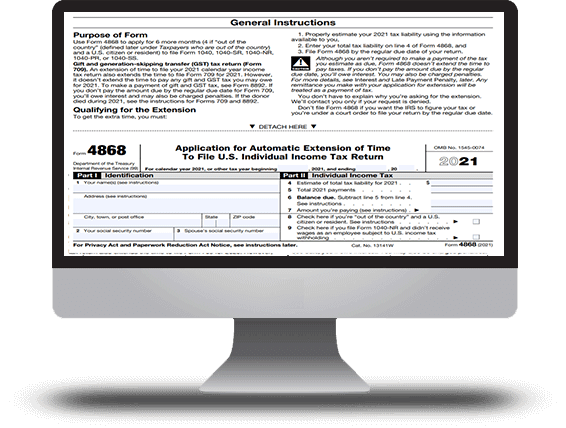

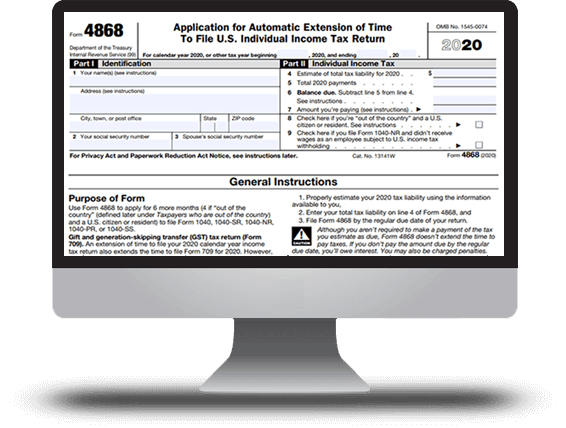

Information Needed to E-File Form 4868

To File form 4868 online, you need to provide the following details:

- Personal details such as Name, SSN, Address

- Total tax liability and Payment for tax year 2023

- Balance due if any

To know more about Form 4868 visit ExpressExtension.

Get upto 6 months extension

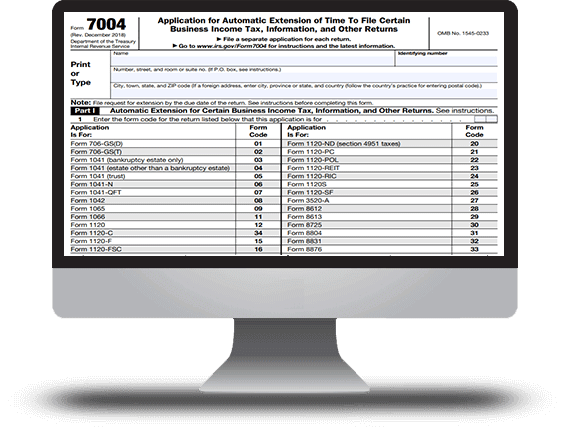

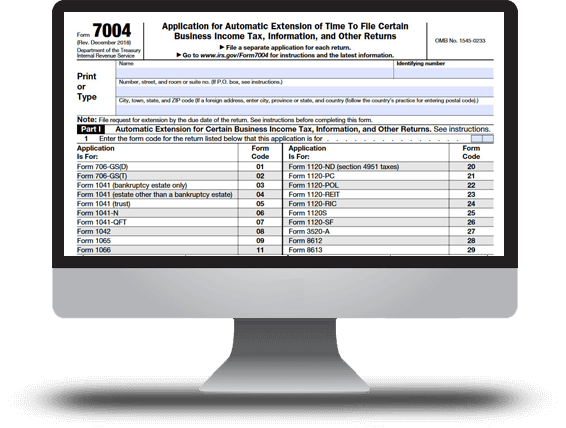

Information Needed to E-File Form 7004

- Business details such as Name, EIN, Address

- Tax Forms for which you are looking to apply for Extension

- The Estimated amount of taxes you owe, If applicable

Note: Filing 7004 online will only extend the deadline for filing business tax returns, the tax payments must be paid by the original deadline.

Get upto 6 months extension

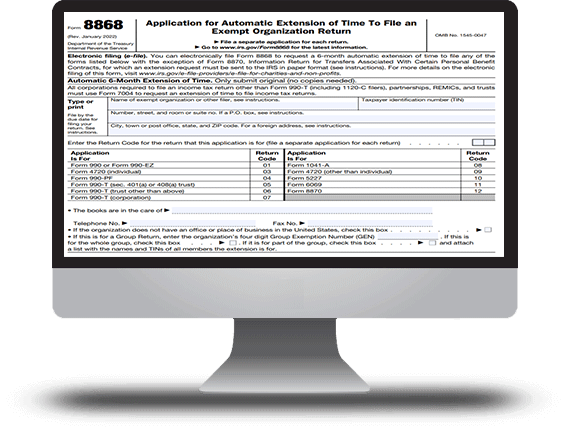

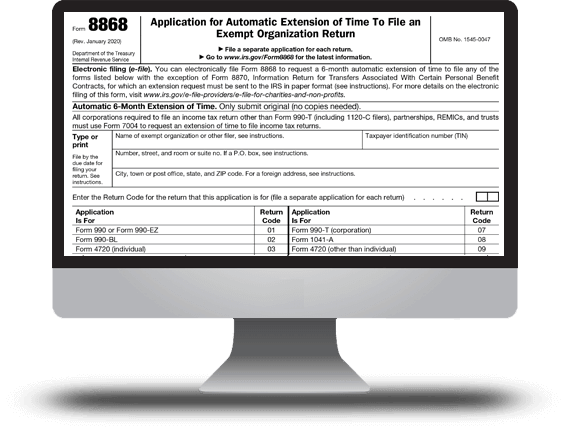

Information Needed to E-File Form 8868

- Organization details such as Name, TIN, Address

- Enter Tax Details

- Balance Tax due, If applicable

Form 8868 is an extension form used by charities, nonprofit groups, and other tax-exempt organizations to obtain an automatic 6-month extension for filing Form 990.

Get upto 6 months extension

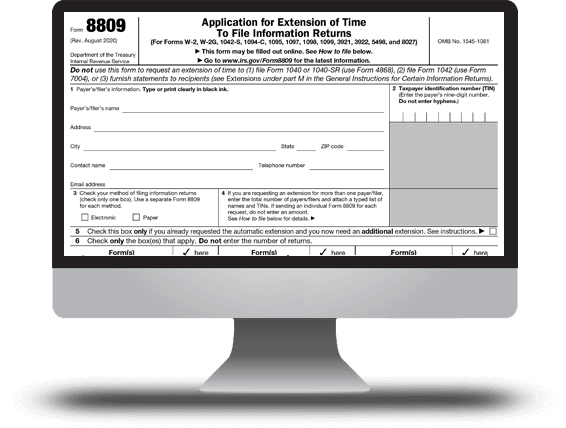

Information Needed to E-File Form 8809

- Tax Payer Details: Name, TIN, Address

- Tax form for which you are looking for an extension

Note: Form 8809 only extends the filing deadline. File Form 15397 to request an extension of the recipient copy deadline for Forms 1099, W-2, and 1095 Forms.

Get upto 6 months extension

Frequently Asked Questions on Tax Extension Forms

IRS Form 7004 is generally used by certain business income tax return filers who want to extend their income tax filing due date for up to 6 months. However, depending on the business type and tax year, the extended deadline will vary.

Form 7004 deadline may vary depending upon the business type and Tax Year. For most of the Businesses, the due date is the 15th day of 3rd month after the tax year ends.

Click here to find your Form 7004 Due Date.

According to the IRS guidance, every employer needs to Follow Form 7004 instructions to complete the filing of form 7004. The instructions include,

- You should provide proper legal name (It must be same as the IRS database)

- EIN (Employee Identification Number)

- Address of your business.

Click here to find out filing instructions for C-Corp / S-Corp extension, and Partnership extension.

You can E-file Form 7004 and save enormous amounts of time and know instantly that your extension form made it to the IRS when you file 7004 online through ExpressExtension.

Also, if your Form 7004 is rejected, you can easily correct the error and transmit it without any additional cost.

Form 4868 is generally used by an individual to extend their 1040 returns filing due date for up to 6 months. The following forms can be extended by using IRS Form 4868. You can E-file form 4868 to get an extension for up to 6 months.

- Form 1040

- Form 1040A

- Form 1040-EZ

- Form 1040-NR

- Form 1040NR-EZ

- Form 1040-PR or 1040-SS

Visit https://www.expressextension.com/irs-income-tax-extension/ to know more about federal income tax extension.

April 15, 2024 (Monday) is the deadline to file a 1040 extension. However, when you file form 4868 online, you can extend your filing deadline to October 15, 2024.

To know more about Form 4868 visit ExpressExtension.

IRS Form 8868 is used by Non-Profit Organizations and Tax-Exempt Organizations to extend their IRS Form 990 income tax filing returns due date upto 6 months.

Form 8868 is due by May 15, 2024, for the 2023 TY. However, by filing Form 8868, you can extend your filing deadline up to October 15, 2024.

If you are a Fiscal Tax year filer, your deadline is the 15th day of the 5th month.

Find my Form 8868 Due Date.

Following forms can be extended using 8868 Form

- Form 990 or Form 990-EZ

- Form 990 BL

- Form 4720 (Individual)

- Form 990-PF

- Form 1041 - A

- Form 990-T

- Form 5227

- Form 4720 (Other than Individual)

- Form 6069

- Form 8870

IRS Form 8809 is used by Individuals, self-insuring employers, and applicable large employers to get a 30 days extension of time to file an information Tax Return after the actual due date.

The deadline for Form 8809 varies depending upon the information tax form.

- For IRS Form W-2, Form 1099-NEC and Form 1099- MISC, the deadline is January 31.

- For IRS Form W-2G, 1094-C, 1095, 1097, 1098, 1099, 3921, 3922, and 8027, the deadline is March 31.

- For IRS Form 1042-S and 5492, the deadline is March 15 and May 31.

No! Form 8809 only extends the filing deadline. To request an extension for recipient copy distribution, you must complete Form 15397 and send it to the IRS. For more information about Form 15397, click here.

March 15, 2024, is the deadline to file Form 1042 Tax extension. By filing form 7004 you can extend the deadline for up to 6 months.

Ready to file tax extension Form 7004, 4868, 8868 and 8809?

Request an Extension NowOur Customer Support Options

Best of all, our dedicated support team will be more than happy to assist you every step of the way. Please don’t hesitate to contact us via phone or email with any questions that you may have.

Phone

You can call us at 803.514.5155 from 9:00 a.m. to 6:00 p.m. EST, Monday-Friday.

E-mail us at support@expressextension.com for 24/7 support in English and Spanish.

Chat

You can even chat with us on our website & we’ll walk you through the whole process.