Request Vendors to Complete, E-sign, and Submit Form W-9

Save Time and the Hassle of Paper Forms by Requesting Form W-9 Online Using our Software

About Form W-9

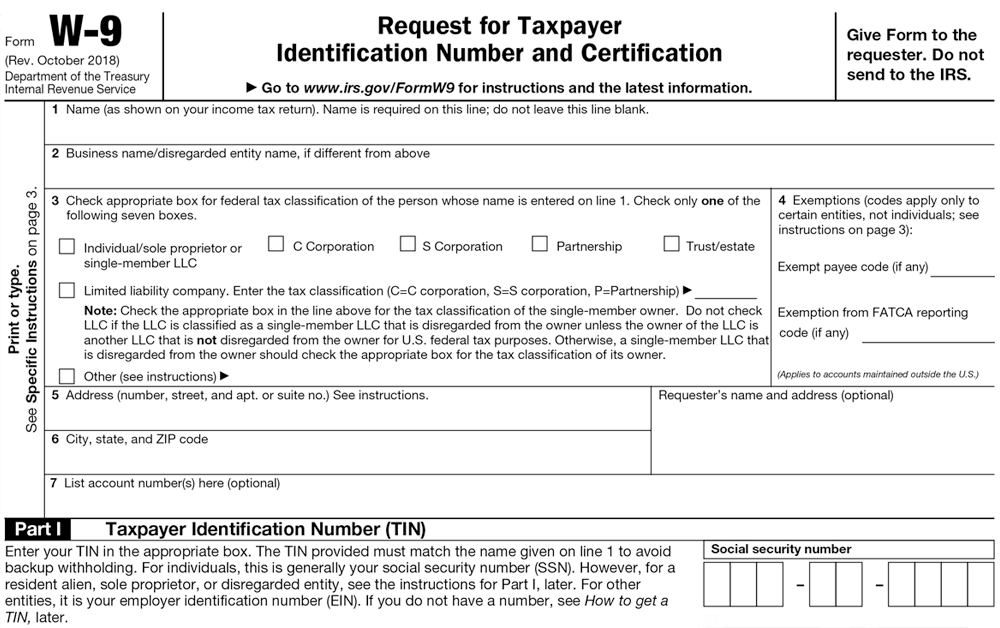

Form W-9 is an IRS Form used to get the Taxpayer Identification Number (TIN) and certifications from vendors who are hired by businesses. Requesting Form W-9 on paper is a bit of a hectic process. Requesting and receiving Forms W-9 online means the process can be completed in minutes.

Form W-9 is a great tool for businesses and individuals that work with vendors. At the end of the tax year, if you have made payments over $600, you are required to file a Form 1099, you must have the Taxpayer Identification Number of the vendor to do so.

Click here to learn more about W-9 Form.

What are the informations required to complete Form W-9?

On the Form W-9, vendors will need to provide their basic information and/or their business’ information. This includes the legal name, address, and their business type (if applicable).

The most important information required on Form W-9 is the Taxpayer Identification Number, this will be either the Social Security Number (SSN) or the Employee Identification Number (EIN).

Vendors must also sign the form, certifying that they have provided accurate information.

Who is subject to backup withholding?

Backup withholding is a consequence of failing to provide a correct TIN on Form W-9 or not completing and submitting the form. Backup withholding is carried out by the business that makes payments to the vendor. The IRS requires them to withhold 24% of payments made to the vendor and deposit it to the IRS until the vendor provides an accurate TIN.

Visit https://www.taxbandits.com/backup-withholding/ to learn more about backup withholding.

Getting Started

If you need to request a W-9 to be filled out and signed by a vendor, you can do so securely and easily by signing in or creating a free account with ExpressIRSForms.com.

Setting Up a Payer

If you are a payer requesting Form W-9 online from your vendors, then go to the Dashboard of your account, and click "Start New Form" to begin entering in information. You will need the payer's name, TIN/EIN, address, and contact information.

Sending Your Request

The next step is entering the name and email address of the vendor from whom you need completed W-9 forms. You can enter this information manually or select contacts from your Address Book. Then send an e-request to the vendor to complete and e-sign Form W-9.

Vendors can create a free account and complete their W-9 Form (enter Name, Address, TIN, Tax Classification) and submit it back.

Reviewing Your Formst

You will be notified when the vendor submits the form and you can access a summary of the W-9 forms you've requested from the "Summary of W-9 Forms" page of your account. You can view the status of each form and review or resend a request all from this page as well.

You have the option to reject any requested W-9 at any time before e-signing and submitting. You can also download a copy of the completed W-9 to keep for personal records.

Once the W-9 Form you requested has been completed and e-signed, the status of the form will change to "Signed" in your account. You can review and accept each W-9 as they are updated. Once you've accepted a W-9, you can click "Update to Address Book" to update your contact's entry to match the new information you have on the W-9. You can also download a PDF of your W-9 forms at any time from your account.

Ready to request that your vendors e-Sign Form W-9?

Features

With features such as TIN matching, errors are avoided by checking the TIN against the IRS database. For a large number of vendors, the bulk upload feature can be used. The year-end filings of 1099 Forms can be easily filed with the vendors’ saved information.

Fill out & share your W-9 online

TaxBandits’ Fillable W-9 solution allows users to quickly complete and e-sign the W-9 form in minutes, Our system performs basic data validations to ensure accuracy and error-free completion. W-9s are securely stored, allowing users to access, edit, or share them anytime.